What Is the Fear and Greed Index for Crypto? How Does It Perform?

What is the Fear and Greed Index?

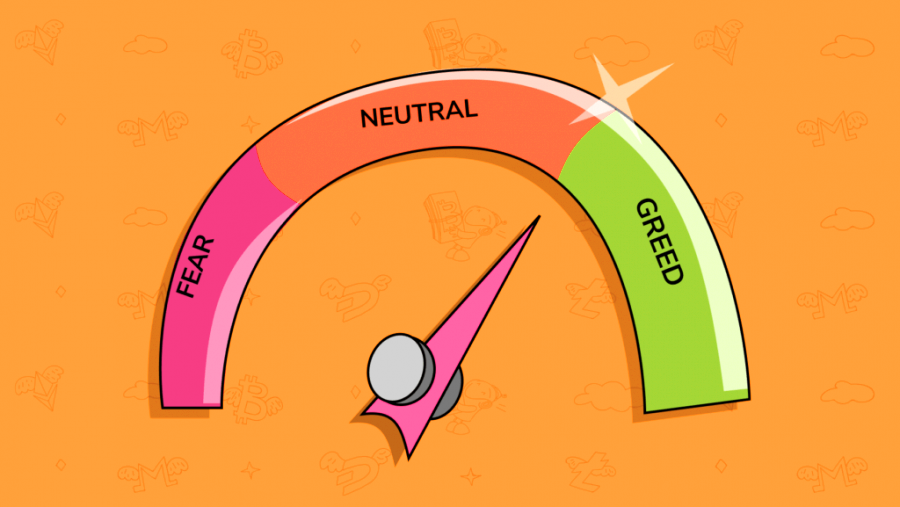

The fear and greed index can be used to look at changes in the stock market and decide if the prices of stocks are fair. The theory is based on the idea that stock prices tend to go down when there is too much fear but go up when there is too much greed. CNNMoney created a fear and greed index to measure investors’ feelings about the stock market. Alternative. I have also made a “crypto fear and greed index” to determine how investors feel about the cryptocurrency market.

How to Understand the Fear and Greed Index in Crypto Markets

Cryptocurrency markets are heavily affected by how buyers and sellers feel. This means that one nasty piece of news can wipe out the market, while one good amount of information can send it to a new high. The emotions of buyers and sellers significantly affect how much people want to buy and sell cryptocurrencies. This creates a “fear and greed” situation. Several things can cause such market sentiments.

When big companies start to pay attention to Bitcoin, a feeling called “fear of missing out” (FOMO) sets in, making other retail traders want to act quickly. So, if people are bullish or work the same way in certain situations, there is an excellent chance to make money or take the proper position.

Read More: Crypto Wallet vs. Banking: Which is a Better Choice?

At this point, the Fear and Greed Index comes into play. The main goal of this index is to measure how digital token traders feel about the market right now and help them decide what to do next. It’s important to know that the Fear and Greed Index doesn’t react strongly to long-term bull runs. Instead, it responded strongly to recent global news events and short-term changes in the cryptocurrency market.

Key Characteristics of the Fear and Greed Index

Here are the characteristics of the fear and greed index:

- Evaluates the participants’ market sentiment for cryptocurrencies.

- Utilizes multiple measures, including volatility, market momentum, volume, and fundamental social media sentiment.

- Analyze market sentiments during periods of intense fear or excessive greed.

- Aids participants in the cryptocurrency market in making informed decisions.

- The index is calculated yearly, monthly, daily, and weekly.

How the Fear and Greed Index Works

Some investors look at the market with the help of the fear and greed index. It is based on the idea that too much anxiety can cause stocks to trade for much less than what they are worth, while too much greed can cause stocks to go for much more than what they should be worth. Some doubters don’t think the index is an excellent investment method because it promotes a market timing strategy instead of a buy-and-hold strategy.

The fear and greed index looks at seven things to determine how much fear and greed are in the market. Here’s how:

- Stock Price Momentum: A measure of the Standard & Poor’s 500 Index (S&P 500) versus its 125-day moving average (MA).

- Stock Price Strength: The ratio of stocks hitting 52-week highs to those hitting 52-week lows on the New York Stock Exchange (NYSE).

- Price Breadth: A comparison of trading volumes in rising and falling stocks.

- Put and Call Options: The extent to which put options lag behind call options, indicating greed, or outperforming them, showing fear.

- Junk Bond Demand: Gauging appetite for higher risk strategies by measuring the spread between investment-grade and junk bond yields.

- Market Volatility: CNN calculates the Cboe Volatility Index (VIX) by focusing on the 50-day moving average.

- Safe Haven Demand: The difference in returns between stocks and government bonds.

On a scale from 0 to 100, these seven things are scored. The index is found by taking the average of all the indicators. A reading above 50 means you are more greedy than usual, while a reading of 50 is neutral.

Factors that Fear and Greed in the crypto market

The Fear and Greed Index in crypto markets is based on the following metrics:

- Volatility

- Volume

- Surveys

- Social Media

- Trends in Google Search

- Dominance

1. Volatility

These seven things are scored on a scale from 0 to 100. Taking the average of all the indicators gives us the index. If your score is above 50, it means you are more greedy than usual. If your score is 50, it means you are neutral.

2. Volume

When there is more greed in the market, more people buy. As a result, as the volume of cryptocurrency goes up, more traders join in. The index figures out the current book by taking the averages from the last 30 or 90 days.

3. Surveys

Users’ and investors’ opinions are the most important and affect how much digital tokens cost. The market gets greedy when more positive surveys cause the index to increase faster.

4. Social media

Information based on cryptography needs to be shared quickly, and social media platforms are often a big part of that. The cryptocurrency markets are affected a lot by social media sites like “Twitter.” Instead, a single tweet can set the tone for the market or completely crash it.

5. Trends in Google Search

The Fear and Greed Index’s final value also considers Google search trends. The more people are interested in digital tokens, and the more greed is likely to be seen on the market. For example, the price of digital tickets has changed significantly when there are more Google BTC searches.

6. Dominance

Bitcoin is the most well-known cryptocurrency market. So, the Fear and Greed index looks at how powerful Bitcoin is in the whole market to figure out how people feel about the cryptocurrency market as a whole. When Bitcoin is more dominant, the market is more likely to be afraid, and when Bitcoin is less prevalent, the market is more likely to be greedy.

Pros of a Fear and Greed Index

Behavioural economists say that it is a reliable sign of changes in the market. For example, the Dot-Com bubble was caused by consumers’ greed, which led to a bubble in the internet market.

We can use it to help you choose where to put your money. Using this index, an investor can take advantage of opportunities to buy and sell. Extreme fear among investors can signify that it’s time to buy, while greedy investors can mean that the market needs a correction.

.Cons of a Fear and Greed Index

It is seen less as a way to research investments and more as a way to judge when to buy or sell. Because of fear and greed indexes, stock trading often makes the market more volatile. They also say that evidence from the past shows that this is a less effective strategy.

How Do Fear and Greed Impact Investor Decisions?

Fear and greed are the two primary emotions that affect investors, and many investors act based on their feelings and are quick to make decisions. Some research says that fear and greed can change us because they make us ignore reason and self-control. Fear and greed are potent motivators when it comes to people and money.

Conclusion

Since the end of 2022, the cryptocurrency market has been in a bearish trend, and the most significant coins, such as BTC, XRP, ETH, and SOL, have continued to lose a lot of value due to worries about the FTX, inflation, and liquidity. The Fear and Greed Index can help determine how people feel about the crypto market as a whole and predict how it will move in the future. This can be especially helpful when the market is in a long-term bearish trend.